Cash Generation > Diagnosing The Reasons For Low Cash Flows And Profitability For A Furniture Design Business

Challenge

Challenge

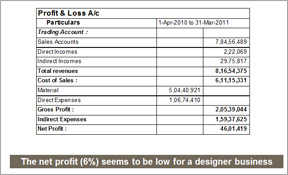

Client is an SME operating in the furniture design and retail business. The company had been witnessing moderate growth in the past two to three years but was not performing well as far as cash flows and profitability was concerned. The company approached Vinculum asking us to help them understand what was happening and why.

Diagnosis

Diagnosis

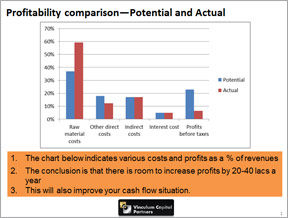

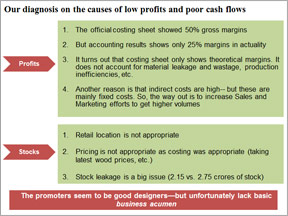

- We diagnosed that the key reason behind the low profits and cash flow was that the client was operating at a much lower efficiency level than it thought.

- Client was pricing its products based on an estimated costing sheet. It turned out that the costing sheet did not account for material leakage and wastage, production inefficiencies, etc.

- This made a difference of 25% in margins.

- Also, the client was not even aware that actual costs were higher than expected.

- This was happening due to inefficiencies and pilferage in the system.

Approach

Approach

The project was run over a four-day period. We conducted a hypothesis-driven diagnosis by analyzing client’s P&L and balance sheet, and cash flows. We also assessed client’s inventory situation and expected costing sheets for its key products. This very clearly indicated that client’s business reality and estimates had a big divergence.

Inputs

Inputs- Client’s financial performance data.

- Interviews with key client personnel.

Results

Results

Client agreed with our diagnosis and as a first step, they have started measuring KPIs to monitor and fix the issues.